SIOUX FALLS, S.D. — A new coalition opposed to eliminating the sales tax on groceries says if the ballot measure passes on Nov. 5, it could wipe out more than just the intended state sales tax, cause cuts to public services and even lead to a state income tax — all claims that the measure’s organizer rejects.

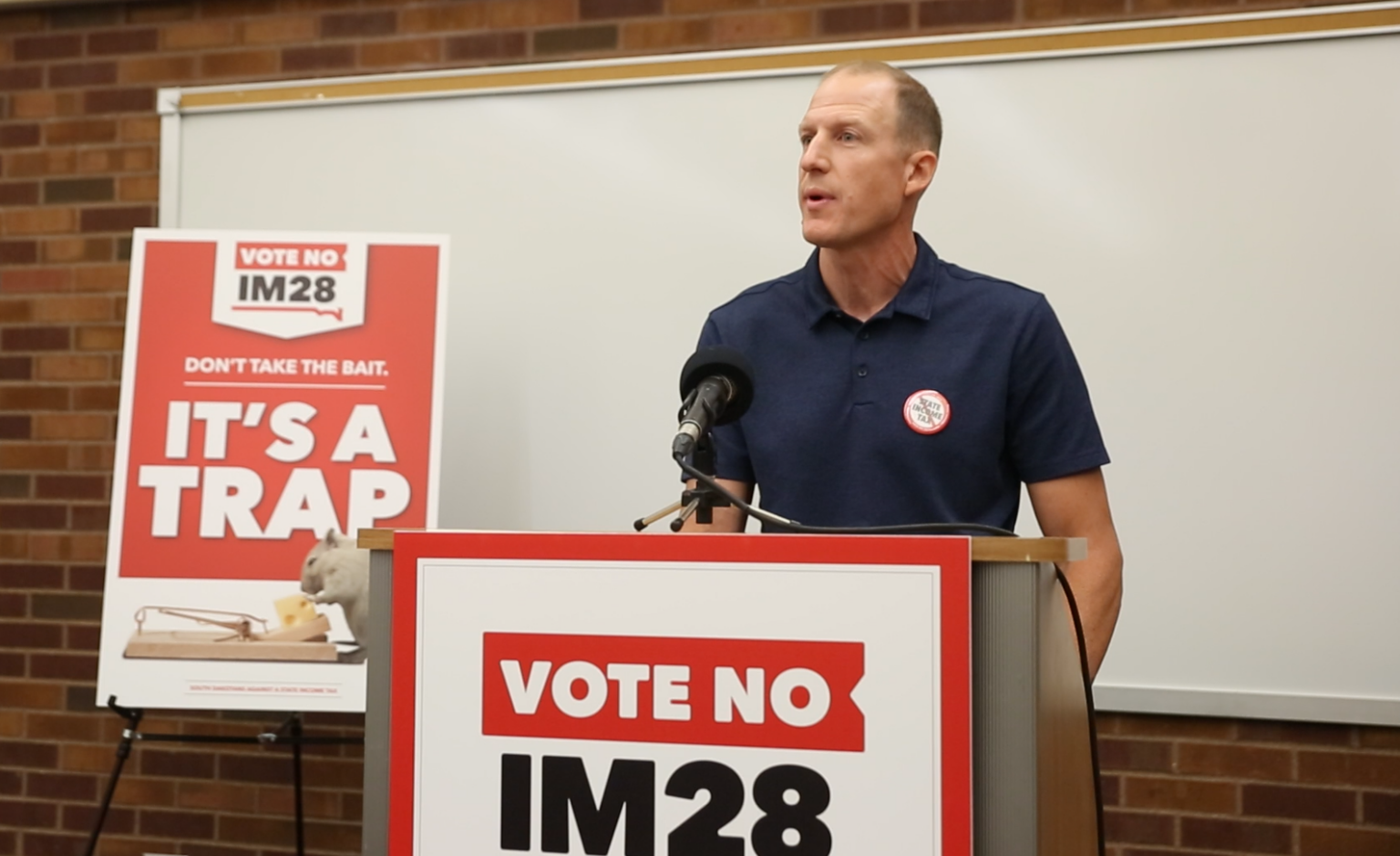

Nathan Sanderson is a coalition member and executive director of the South Dakota Retailers Association. At a Tuesday press conference announcing the coalition’s formation, he said reinstituting the tax after its repeal would be difficult because a two-thirds vote of the Legislature is required to raise a tax.

That means government revenue losses could be permanent, according to Sanderson.

“And so we’re going to be stuck with significant funding cuts for education, health care, human services and those kinds of things,” he said.

Meanwhile, the leader of the group behind the ballot measure said budget cuts were not a concern when Republican Gov. Kristi Noem tried but failed to eliminate the state sales tax on groceries in 2023.

“When Kristi Noem supported this, she didn’t have any of those concerns. She didn’t think any of this was going to be a problem,” said Rick Weiland, chairman of Dakotans for Health.

The coalition opposing the tax cut includes the South Dakota Retailers Association, the South Dakota Chamber of Commerce, the South Dakota Education Association and other organizations. The coalition’s name, “South Dakotans Against a State Income Tax” — which is also the name of the group’s official fundraising committee — comes from the coalition’s claim that an income tax ballot measure will follow the budget cuts.

“We believe it’s only going to be a couple of years of very low to flat to negative funding before we’re going to see a ballot measure that would impose an income tax on South Dakota,” Sanderson said.

South Dakota has not had an income tax since the 1940s. It was imposed during a period of heightened Democratic Party power during the Great Depression.

The Legislative Research Council projects the state budgetary hole created by the ballot measure would be $123.9 million annually.

The coalition says that doesn’t account for other potential revenue losses that could grow the amount to $176 million. The state collects $43 million in tobacco taxes annually, the coalition says, and another $22 million annually from a legal settlement with tobacco companies, which requires a sales tax on tobacco to collect.

The state attorney general has indicated that because the ballot measure would prohibit taxes on anything sold for “human consumption,” except alcoholic beverages and prepared food, tobacco taxes could be affected.

Weiland said if coalition members are concerned about tobacco taxes, they could lobby the Legislature to amend the measure after it passes.

Concerns about sales-tax exemptions fall flat, Weiland added, when considering that the state already has $1.4 billion worth of sales and use tax exemptions for various categories of businesses and services.

“This is about providing some relief to families,” Weiland said.

Additionally, he called the income tax claim fear-mongering.

“Give me a break,” he said. “That ain’t going to happen. It’s a fool’s errand. South Dakotans would never vote for that.”

In addition to the state revenue impact, the coalition says the measure would prevent cities from collecting sales taxes on groceries, further straining local budgets.

The measure targets state sales taxes only and says “municipalities may continue to impose such taxes,” but coalition members said that language won’t hold up.

“A city cannot collect taxes on something that the state does not also tax,” said coalition member and Sioux Falls Mayor Paul TenHaken, pointing to state law.

He said eliminating the tax, rather than lowering the state tax rate to 0%, is the key difference for cities between the ballot measure and the failed legislation that Noem introduced. TenHaken said Noem’s legislation would have allowed city sales taxes on groceries to continue.

Weiland called that argument a farce and said again that legislators could amend the measure after it passes if they’re concerned.

TenHaken also expressed concern that if the measure passes and the state’s revenue streams weaken, it could hurt the state’s bond rating. And because local governments depend on the state’s bond rating, the interest rate for a new school or athletics facility could rise.

The coalition also says the measure would reduce funding for tribal governments through sales tax compacts — an argument tribes made against Noem’s legislation in 2023.

“Noem said that’s not a problem, we can renegotiate that,” countered Weiland. “And most importantly, again, even if these concerns were valid, they are all issues the Republican-dominated Legislature could address. They have absolute control.”

That’s not a risk opponents want to take with what they call a “sloppy” ballot measure.

“You’re rolling the dice that the Legislature hopefully does what is right,” TenHaken said. “I’d rather kill this thing before it gets to that point.”

Among the 45 states that collect a statewide sales tax, South Dakota is currently 36th in combined state and local rates, making it one of the lowest.