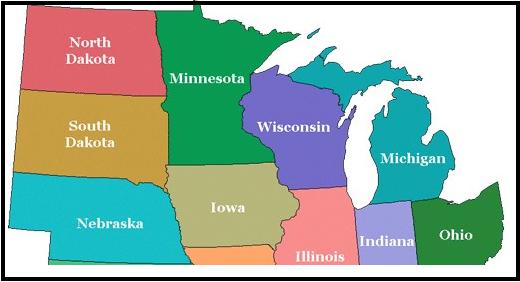

OMAHA, Neb. — For a second straight month, the Creighton University Mid-America Business Conditions Index, a leading economic indicator for the nine-state region stretching from Minnesota to Arkansas, climbed above the 50.0 growth neutral threshold in October.

Overall Index: The Business Conditions Index, which uses the identical methodology as the national Institute for Supply Management (ISM) and ranges between 0 and 100 with 50.0 representing growth neutral, dipped to 51.5 from 52.5 in September.

“The Mid-America regional manufacturing economy has weakened from earlier in the year and from the same period in 2022. Approximately 60% of supply managers expect an economic downturn in the first half of 2024,” said Ernie Goss PhD, director of Creighton University’s Economic Forecasting Group and the Jack A. MacAllister Chair in Regional Economics in the Heider College of Business.

The Mid-America report is produced independently from the national ISM.

Manufacturing supply managers in Creighton’s October survey named the greatest economic risks for their firm’s business activity in the next six months. Approximately 4 of 10 indicated excessive inflation; labor shortages were identified by 3 of 10; supply chain disruptions were registered by 2 of 10 and; higher interest rates were reported by 1 of 10 as the top economic threat.

Said one supply manger, “We cannot hire and train workers fast enough to help increase our volume of finished goods.”

“The rapid expansion in federal government spending and debt will push the Federal Reserve to keep its foot on the economic brakes via raising short-term rates. I expect one more rate hike in quarter four — with no change at the Fed’s Oct. 31-Nov. 1 meetings and a 25-basis point (0.25%) increase at its meetings on Dec. 12-13,” said Goss.

Employment: The regional hiring gauge sank below growth neutral to 47.5 from 51.5 in September. “According to U.S. Bureau of Labor Statistics data, the regional average manufacturing wage rate climbed by 3.4% over the past 12 months or slightly below the 3.7% increase in consumer prices,” said Goss.

“Despite job losses for October, Creighton’s monthly survey indicated levels maintained due to manufacturers’ labor hoarding. Employment readings over the past several months signal an upturn in layoffs in the region. The regional manufacturing economy increased employment by 0.7% over the past 12 months. This is the weakest year-over-year gain for all of 2023,” said Goss.

Other comments from supply managers in October:

- “Geopolitical climate is what we are watching, not only in Ukraine/Russia but China/Taiwan, and the Middle East and could cause disruptions to the supply chain.”

- “The rest of us are left to pick up the pieces and make the best of a terrible situation. WWIII is one poor decision away from reality.”

- “There are so many cross currents (war, inflation, labor, fuel); and, general uncertainties that it is nearly impossible to predict future trends. However, we must remain vigilant and flexible to maintain our supply chain to serve our clients.”

- “Inflation and social spending (spending period) are out of control. Prices are high and no one wants to work. This is not sustainable.”

Wholesale Prices: The wholesale inflation gauge for the month dropped to 55.0 from 68.2 in September. “Manufacturing supply managers expect prices for the products and services they purchase to increase by 4.2% over the next six months. This would represent a significant upturn in inflationary pressures in the months ahead,” said Goss.

“Even with consumer inflation above its 2.0% target, as I indicated earlier, I expect the Federal Reserve to make no change to short-term interest rates at its Oct./Nov. meetings but raise rates by 25 basis points (0.25%) in the last quarter of this year at its December 12-13 meetings,” said Goss.

Confidence: Looking ahead six months, economic optimism as captured by the October Business Confidence Index sank to 25.0 from September’s 29.6. “Approximately 6 of 10 supply managers expect slumping business conditions over the next six months,” said Goss.

Inventories: The regional inventory index, reflecting levels of raw materials and supplies, sank to 50.1 from September’s 54.9. “Manufacturing firms have been expanding inventory levels since February of this year, but with recent slower growth,” said Goss.

Trade: Trade numbers were once again weak for the month with new export orders increasing to a weak 41.7 from September’s 34.5. September imports increased to 50.2 from 44.1 in September.

Other survey components of the October Business Conditions Index were: new orders increased to 50.0 from 48.4 in September; the production or sales index dipped to 49.8 from 50.0 in September; and the speed of deliveries of raw materials and supplies climbed to 60.0 from September’s 57.6. The increase indicates an upturn in supply chain disruptions and delivery bottlenecks for the month.

The Creighton Economic Forecasting Group has conducted the monthly survey of supply managers in nine states since 1994 to produce leading economic indicators of the Mid-America economy. States included in the survey are Arkansas, Iowa, Kansas, Minnesota, Missouri, Nebraska, North Dakota, Oklahoma and South Dakota.