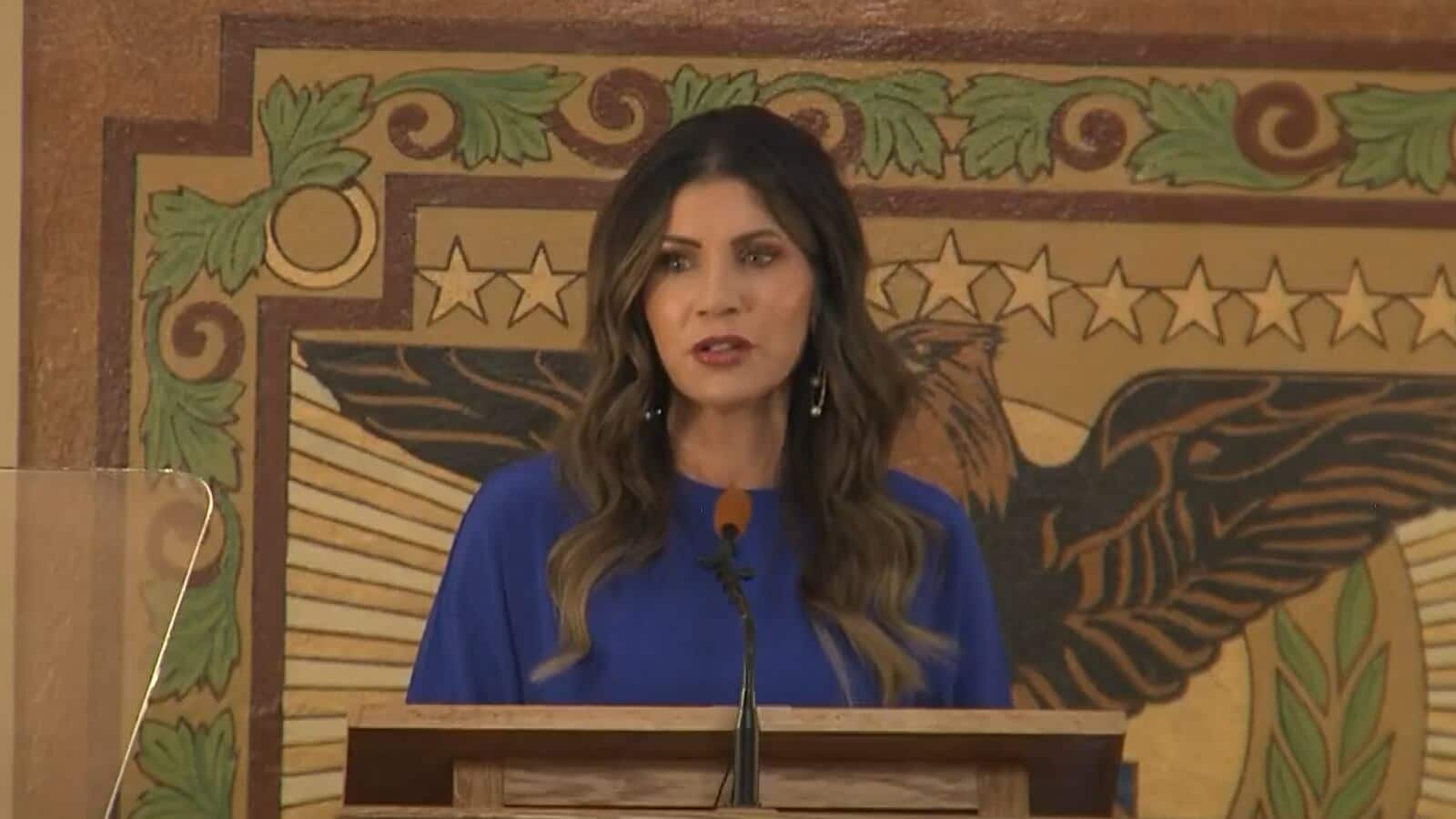

PIERRE, S.D. – Gov. Kristi Noem set the tone for the 2024 South Dakota Legislature not with her session-opening State of the State Address but with her budget message in December.

The second-term Republican touted a doctrine of financial discipline and austerity, embracing a tradition of South Dakota governors relishing not the breadth of executive achievements but the fruits of their frugality.

“It’s a budget that prioritizes people, not programs,” Noem told legislators gathered in Pierre, S.D. “It’s a budget that shows what can be done with smart, conservative fiscal policies. And it’s a budget that focuses on our core responsibilities of state government.”

The fact that the governor’s proposed Fiscal Year 2025 budget is $7.28 billion – nearly 30% higher than just two years ago – muddles that belt-tightening mantra. It also highlights uncertainty about the state’s long-term financial outlook, according to News Watch budget analysis and interviews with legislators, business leaders and current and former executive staffers.

The Republican-controlled Legislature is, to borrow Noem’s metaphor, keeping its foot on the gas. Lawmakers overshot Noem’s budget request last session while cutting the state sales tax rate from 4.5% to 4.2%, a dangerous mix in most times but considered palatable due to federal stimulus money still boosting state coffers.

Despite Noem’s public criticism of President Joe Biden’s stimulus strategy, federal money accounts for 47% of the state’s current budget, fueled by surplus from COVID-era initiatives such as the American Rescue Plan and the Bipartisan Infrastructure Law.

“Pull that out of our budget and see what happens,” said Democratic Rep. Linda Duba of Sioux Falls, S.D., who entered the Legislature in 2019 and serves on the Appropriations Committee.

Budget increases build on previous bumps

The rising tide and inevitable ebb of federal money is what concerns Duba and others who see a budget reckoning down the road, most likely after Noem leaves office. The governor’s term ends in 2026, but it’s no secret that she covets a vice presidential nod from the GOP primary front-runner, former President Donald Trump.

Other potential landing spots for Noem include a Cabinet role in a potential Trump administration or filling the leadership void left by longtime National Rifle Association chief executive Wayne LaPierre, who resigned Jan. 5 amid corruption charges.

Even if she stays, many of the budget-related decisions made today won’t germinate until 2026 or 2027, when stimulus money wends its way out of the state economy and the enormity of costs for new prison projects become clear. The sentiment among many stakeholders in Pierre is that it’s going to be somebody else’s problem.

The governor’s proposed Fiscal Year 2025 budget for state general funds is $2.39 billion, an increase of 8.3% over last year’s proposal. That follows an increase of 11.3% from 2023 to 2024.

Noem chided lawmakers in her budget address for going above and beyond her recommendations last session, resulting in general fund spending of $2.28 billion. Legislators also rejected her much-ballyhooed 2022 campaign promise to repeal the state grocery tax, choosing to lower the general sales tax rate instead.

Republican Rep. Tony Venhuizen of Sioux Falls, a former chief of staff to Govs. Dennis Daugaard and Noem, sees these budget trends as a positive reflection of South Dakota’s economy. The general fund budget is tied to sales tax projections, the state’s largest source of non-federal revenue.

“One thing you have to keep in mind is that these (budget) increases accumulate,” said Venhuizen, who also serves on the Appropriations Committee. “If you go up 12% one year, then you go up 9% and then the third year you’re only going up 3 or 4, that’s still on top of the previous increases. It’s not as if we’re going backwards. We’re going back to a more normal growth pattern.”

All eyes on consumer spending

That “back to normal” message is prevalent in Pierre these days, though abnormalities exist. Circumstances are unique because of pandemic stimulus and infrastructure funds, creating pools of uncertainty as the federal spigot slows.

Most of the federal money is spent on one-time projects within certain parameters – housing, broadband, water projects, construction at universities. Its effect on the general economy is harder to predict, but there are warning signs that people could spend less money in 2024. The impact of stimulus checks on personal savings has started to wane and credit card debt is at an all-time high, according to the Federal Reserve Bank of New York.

“A year ago, many commentators were skeptical and calling for a recession, but the recession never came,” Jack Kleinhenz, chief economist of the National Retail Federation, said in the January issue of NRF’s Monthly Economic Review. “With each passing month, consumers kept spending despite inflation and higher borrowing costs. Nonetheless, those tailwinds are not necessarily sustainable.”

To put it simply, people spending less money means less sales tax revenue. So does lower inflation, though economists differ on where prices are headed in 2024. The overall Consumer Price Index in December was up 3.4% nationally over the last 12 months, compared to 3.1% in November.

Jim Terwilliger, Noem’s top budget official as commissioner of the Bureau of Finance and Management, told News Watch that these factors are outweighed by a state economy that the governor calls “one of the strongest in the nation.”

South Dakota’s real gross domestic product went up 5.2% during the third quarter of 2023, tied for 15th nationally in rate of increase from the previous quarter, according to the U.S. Bureau of Economic Analysis. Personal income rose 3%, tied for 35th in terms of percentage increase.

“Although federal COVID stimulus funding has been ramping down, I expect our economic growth to offset those impacts,” Terwilliger said in an emailed response to questions. “The vast majority of COVID-related stimulus spending, such as direct checks to citizens and taxpayers in 2020 and 2021, has circulated through the economy and our economy continues to grow.”

‘Don’t bet your lunch money on it’

Sales tax receipts are projected at $1.43 billion for FY 2024, down 3.1% from the previous year. Venhuizen noted that the downturn can be traced not to unforeseen factors but to the sales tax rate cut, which pruned about $100 million from annual receipts.

“That’s an artificial change because of the rate change,” he said. “Last year the sales tax (revenue) went up 9%, so the growth is slowing down, but it’s also back to a more normal growth pattern. High inflation plays a role. If things cost more, then your sales tax (revenue) is going to go up. We’ve felt the effects of those things over the last two or three years, and now they’re baked into the ongoing budget.”

At Noem’s behest, Terwilliger testified Jan. 11 in favor of HB 1001, which would remove the 2027 sunset clause from last year’s sales tax cut and make the change permanent. The bill passed the House a day later on a 54-12 vote.

“When we (passed the cut) last year, we had a lot of new money coming in and built a lot of ongoing spending into the budget in addition to the cutting the tax,” Venhuizen said. “So that was built into the budget last year, and the budget has absorbed that tax cut. It’s very hard for me to imagine that in another two or three years that we would actually want to have that tax rate go back up. So I don’t see why we wouldn’t just make it permanent and move on.”

There are differing views in the Senate, which pushed for the sunset clause as a compromise last session and will likely be resistant to making the cut permanent. Republican Sen. Lee Schoenbeck of Watertown, S.D., President Pro Tempore of the Senate, told News Watch that he does not support HB 1001.

When asked if he thought it would pass the Senate, he responded, “I’ll leave it to others to predict, but don’t bet your lunch money on it.”

Grocery tax ballot measure draws support

One of the reasons for caution is a petition being circulated to place a grocery tax repeal on the November 2024 ballot. If successful, the measure would prohibit the state from collecting sales tax on “anything sold for human consumption.”

A statewide poll co-sponsored by South Dakota News Watch showed that 60.6% of registered voters support the proposed statewide ballot measure brought by Dakotans for Health, a grassroots organization that seeks non-legislative solutions to public health issues.

The fiscal note for the measure shows an estimated annual reduction in sales tax receipts of $124 million if the measure passes, which could put the state in a pinch when combined with the rate change on general sales tax.

Terwilliger told News Watch that Noem doesn’t support the ballot initiative because of concerns about the wording. He added that the governor “still believes a repeal of the grocery tax is the best tax relief for South Dakota families if it is done in a responsible manner,” though she didn’t mention the repeal in her budget message or State of the State address.

In a News Watch survey response from 28 of 105 state legislators in December, more than half said that they do not support a repeal of the grocery tax during this year’s session. But that doesn’t mean it won’t pass at the polls in November.

Duba was critical of the decision to pursue a general sales tax cut last year instead of the grocery tax repeal, pointing to fundamental disagreements on the role of government when it comes to fiscal policy. South Dakota is one of two states that fully taxes food without offering credits or rebates, which repeal supporters have said has a disproportionate impact on low-income families and individuals.

On making the general sales tax cut permanent, Duba said: “I’m not voting for it. That’s an irresponsible thing to do. Thirty cents out of a hundred dollars is really not helping out families, unless you’re buying some very big-ticket items. The average South Dakotan doesn’t feel this at all. We can brag about it being the largest tax cut in state history, but in terms of family impacts, it was a blip on the radar.”

South Dakota budget lessons from the past

Venhuizen knows what a budget crunch looks like. He was on the executive staff when Daugaard, his father-in-law, entered the governor’s mansion in January 2011.

After two years of federal stimulus money flowing into the state after the Great Recession, the funds filtered out as increased spending continued, leaving a hole in the ledger. The decision was made to slash $127 million from the general fund budget with a scorched-earth session, a cautionary tale that still lingers.

“I think that shows the strength of the state’s economy at the moment compared to back then,” said Venhuizen. “The lesson from that 2011 situation is that you want to be cautious about revenue and not overspend because the worst thing that can happen is that you have to come back the next year and cut. Nobody wants to have to do that.”

The biggest unknown is the new men’s state penitentiary scheduled to be built by 2028 in rural Lincoln County, considered the largest state-funded construction project in state history. Terwilliger noted that Noem and state legislators have already started setting aside money for the Department of Corrections initiative, which also includes a new women’s prison in Rapid City, S.D.

“With Governor Noem’s recommended budget this year, we have set aside more than $650 million of funding towards prison construction costs and expect we will be able to fund those projects with little or no debt over the next few years,” Terwilliger told News Watch.

Others are more skeptical, mindful of cost overruns with previous Noem-era construction projects – such as the Dakota Events Complex at the South Dakota State Fair – and lack of concrete details about the prison project. Several lawmakers have speculated the DEX project will exceed $1 billion, with plenty of overhead in the realm of administration and maintenance.

School lunch bill divides lawmakers

Rep. Kadyn Wittman of Sioux Falls believes there is room for bipartisan agreement on the role of state government when it comes to social policy. The 32-year-old Democrat is the antithesis of the “people, not programs” message that Noem hammered home in her limited-government budget message.

Wittman was inspired to run for public office while working during the pandemic at the Bishop Dudley Hospitality House in Sioux Falls, meeting marginalized individuals and families and trying to improve their life trajectories.

Elected to the House from District 15, the Augustana University alum went to Pierre last session as one of 33 first-time legislators, bursting with ideas despite very little grasp of how to carry them out.

“I had no idea what I was doing last year. Are you kidding me?” Wittman told News Watch. “I rolled into that Capitol thinking I was going to show everybody what’s what, and I got my a– handed to me.”

Her bill to provide free school lunches for South Dakota’s K-12 students was estimated to cost $38.6 million annually and died in the House Education Committee.

Wittman returned this year with a streamlined proposal to provide free meals to students who qualify for reduced-fee lunches by reimbursing schools for the balance on those reduced charges. The fiscal note stands at about $600,000, drawing bipartisan support from seven Republican co-sponsors as of Jan. 12.

Venhuizen expressed concern about inserting state money into a federal school lunch program, noting that the state has plenty of its own obligations. Wittman countered that hungry children are everyone’s concern, noting that 1 in 9 kids in South Dakota are “food insecure,” meaning they lack consistent access to enough food to live an active and healthy life, according to Feeding America.

“I do believe there is a place for state government to meet the basic needs of children that are in its care for eight hours a day during the school year,” Wittman said. “I view it as an investment for the future, and I don’t think it’s a partisan issue at all. It doesn’t matter if a child’s parents are Democrats, Republicans or Independents. If that child is hungry, I think we have an obligation to help meet their basic needs.”